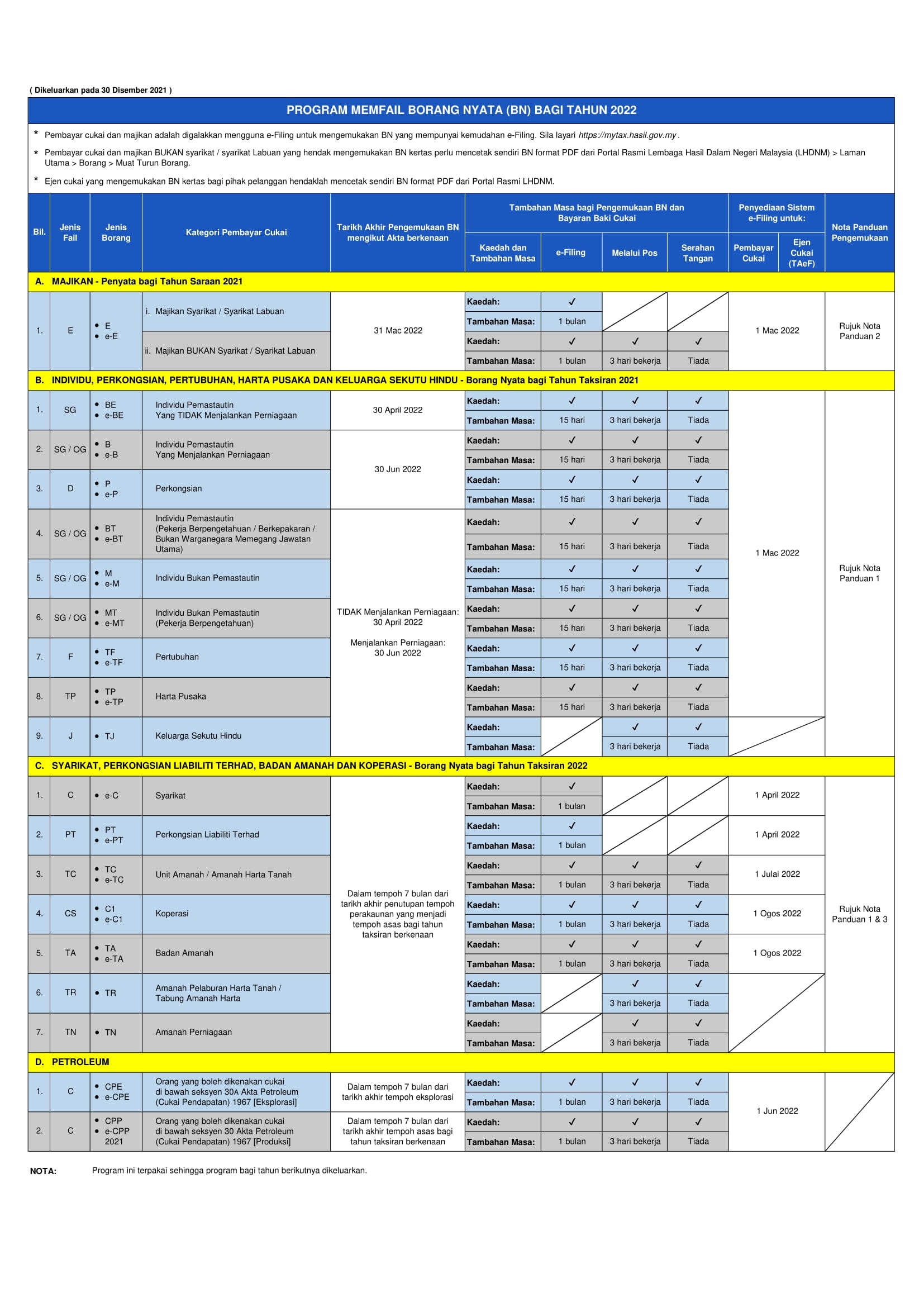

Declaration report of companies Form E deadline. Form P refers to income tax return for partnerships.

Malaysia Personal Income Tax Guide 2022 Ya 2021

Efiling submissions for the 2021 Income Tax Returns for.

. If you forget to file them altogether there are two scenarios that could happen. What Is The Deadline For Income Tax 2021 Malaysia. For the BE form resident individuals who do not carry on business the deadline falls on either 30 April 2022 manual filing or 15 May 2022 e-Filing.

Workers or employers can report their income in 2020 from March 1 2021. Personal income tax filing Form BE deadline. Of tax professionals will be able to assist you in the aspect of tax planning and compliance so as to comply with the Income Tax Act.

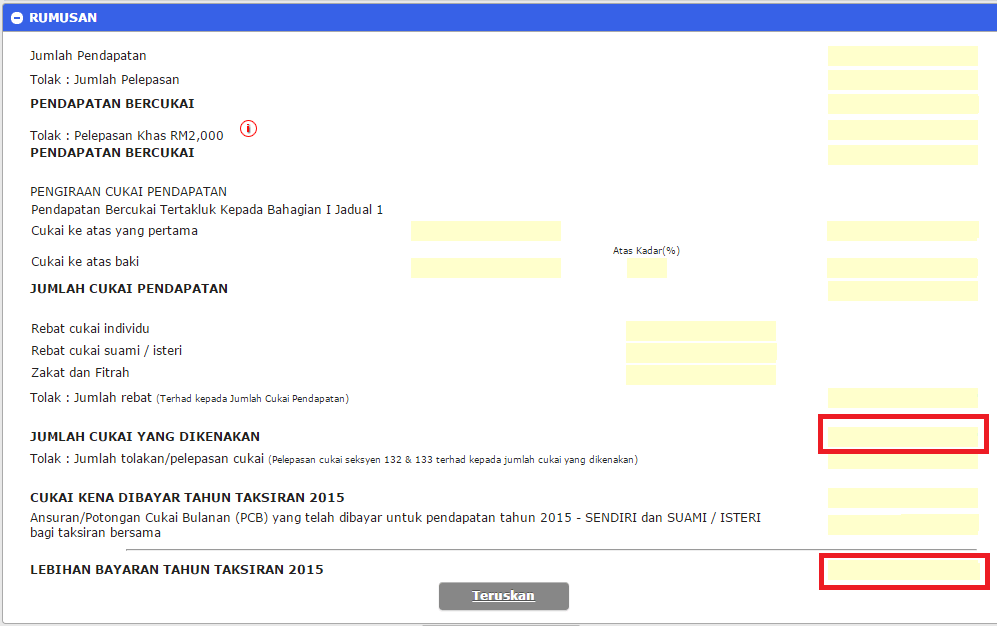

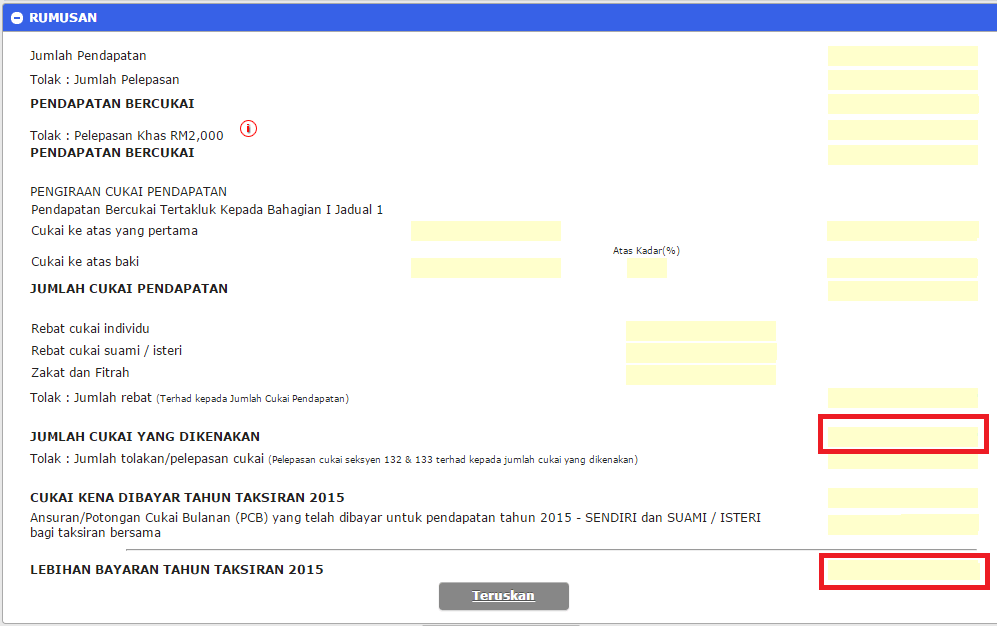

The submission of their income tax form for forms E BE B M BT MT TF and TP can be made through e-Filing. Calculations RM Rate TaxRM A. 30042022 15052022 for e-filing 5.

Extended from 15 July 2021 to 31 Aug 2021 according to LHDN. Employment income e-BE on or before 15 th May. 2022 tax filing deadlines.

LAPORKAN PENDAPATAN TAHUN TAKSIRAN 2021 SELEWAT-LEWATNYA PADA 15 MEI 2022 DAN ELAK PENALTI LEWAT KEMUKA BORANG NYATA CUKAI. The deadline for BE is April 30. The CP38 notification is issued to the employer as supplementary instructions to clear the balance of tax liability of employees over and above the Monthly Tax Deductions MTD 30th June 2022 is the final date for submission of Form B Year Assessment 2021 and the payment of income tax for individuals who earn business income.

Extended grace period for filing. PERSONAL TAX Form BE 30 April 2022. Yearly remuneration statement Form EA Deadline.

Foreign income remitted into Malaysia is exempted from tax. Extended grace period for filing. Meanwhile for the B form resident individuals who carry.

SOLE PROPRIETOR Form B. Income tax return for partnerships Form P. The Malaysian Inland Revenue Department LHDN officially announced the 2021 income tax filing deadline.

Other entities Submission of income tax return. As for those filling in the B form resident individuals who carry on business the. You might just forget to fill up that LHDN form on timePlease note that the deadlines for tax filing are 30th April 2022 and 15th May 2022 for manual filing and e-Filing respectively.

By 31 March of the following year. In this case you may incur a fine of. For example a company that closes its accounts on 30 June of each year is taxed on income earned during the financial year ending on 30 June 2021 for year of assessment 2021.

By 30 April without business income or 30 June with business income in the year following that YA. Although a partnership is not subjected to pay tax it still has to file an annual income tax return Form P to show all income earned and business expenses. Under the self-assessment system companies are required to submit a return of income within seven months from the date of closing of accounts.

Malaysia has implementing territorial tax system. Both residents and non-residents are taxed on income accruing in or derived from Malaysia. However in this article well be solely focusing on Malaysia Personal Individual Income Tax YA2021 that is tax paid by employees in Malaysia.

Individual Tax in Malaysia. Calendar year accounting period ending. The deadline for Form B and P is June 30.

Individuals resident non-resident individuals including knowledge expert workers partnerships associations. Business income e-B on or before 15 th July. Deceased persons estate Association.

Income tax return for partnership. For further information consult the dedicated page on the official website of the Inland Revenue Board of Malaysia. The deadline to submit the BE form is on April 30 while it is June 30 for the B form.

Malaysia Various Tax Deadlines Extended Due to COVID-19 Malaysia Various Tax Deadlines Extended Due The Malaysian Inland Revenue Board MIRB has set out a new timetable for certain personal tax filing and employer compliance obligations including due date extensions in light of the COVID-19 crisis. Form E Important Notes. Income tax return for individual who only received employment income.

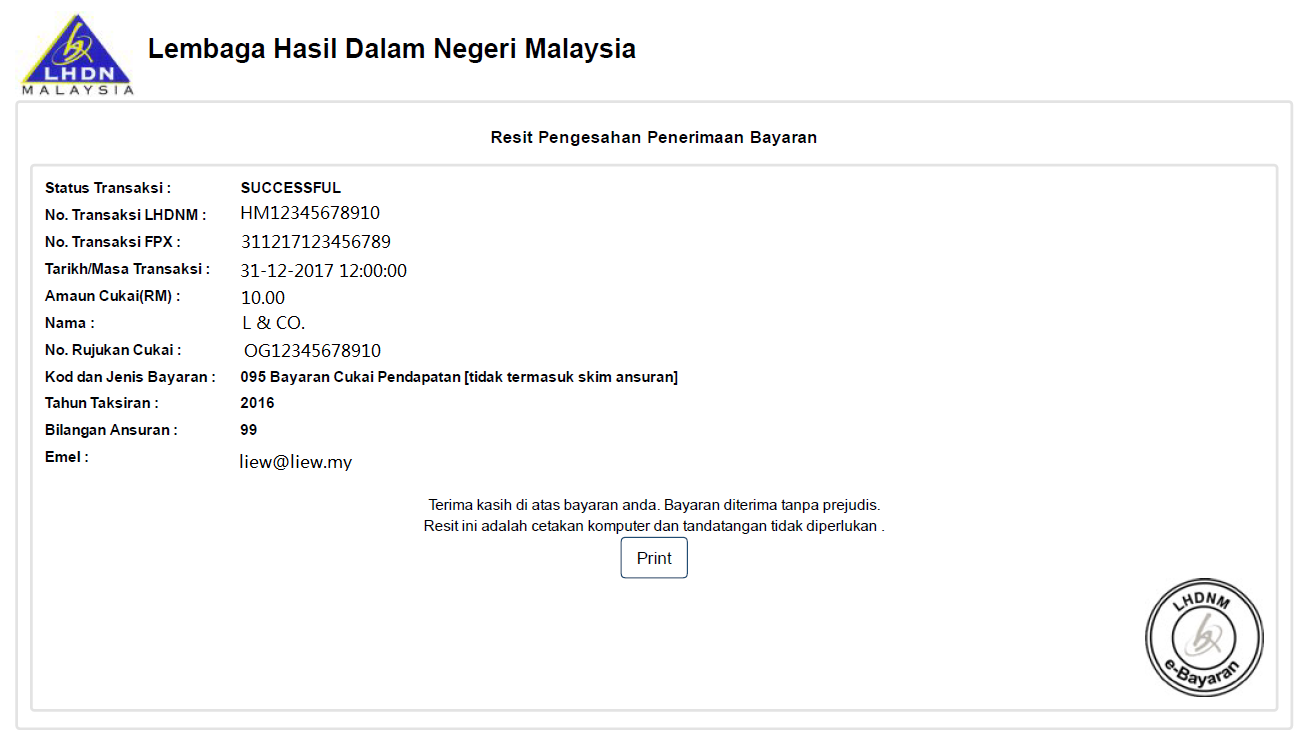

Malaysias tax season begins on 1 March every year with the deadline for resident individuals to file their taxes typically falling on 30 April for offline channels or 15 May for online submissions through e-Filing. The Malaysian Inland Revenue Board on 19 August 2021 announced an additional one-month extension of time to file income tax returns for 2021. Individual Tax Relief in Malaysia.

Business income B Form on or before 30 th June. Income tax return for individual with business income income other than employment income Deadline. Tax Deadline Year 2022.

On the First 5000 Next 15000. Calendar year accounting period ending. 30062022 15072022 for e-filing 6.

Accounting period ending 1 November 2020 through 31 January 2021. Form EA Important Notes. Income tax return for partnerships.

On the First 5000. Thus the new deadline for filing your income tax returns in Malaysia via e-Filing is 30 June 2020 for resident individuals who do not carry on a business and 30. The deadline for submitting Form E is March 31.

The deadline for filing income tax in Malaysia also varies according to what type of form you are filing. Form B Form B deadline. The LHDN could choose to have you prosecuted if you fail to furnish your tax returns.

For further information kindly refer the Return Form RF Program on the. According to the Inland Revenue Board Of Malaysia LHDN failing to pay your taxes on time will incur a 10 increment on your payable tax. Date of online submission may subject to change.

Also the MIRB has closed all. According to Lembaga Hasil Dalam Negeri LHDN the move is meant to facilitate the submission of tax returns affected by the national movement control order which starts today. The deadline for filing income tax in Malaysia also varies according to what type of form you are filing.

Employment income BE Form on or before 30 th April. Lembaga Hasil Dalam Negeri Malaysia HASiL ingin memberikan peringatan kepada semua pembayar cukai yang tidak menjalankan perniagaan agar segera melaporkan pendapatan mereka yang layak dikenakan. For the BE form resident individuals who do not carry on business the deadline for filing income tax in Malaysia is 30 April 2021 for manual filing and 15 May 2021 via e-Filing.

Malaysia Personal Income Tax Guide 2022 Ya 2021

Why Delivering Government It Projects Can Be So Taxing

How To Fix A Mistake In Your E Filing For Malaysians By Juinn Tan Medium

Malaysia Personal Income Tax Guide 2021 Ya 2020

How To Step By Step Income Tax E Filing Guide Imoney

Ks Chia Associates 𝗙𝗔𝗤𝘀 𝗼𝗻 𝘁𝗮𝘅 𝗺𝗮𝘁𝘁𝗲𝗿𝘀 𝗱𝘂𝗿𝗶𝗻𝗴 𝘁𝗵𝗲 𝗠𝗼𝘃𝗲𝗺𝗲𝗻𝘁 𝗖𝗼𝗻𝘁𝗿𝗼𝗹 𝗢𝗿𝗱𝗲𝗿 𝗠𝗖𝗢 𝟯 𝟬 The Malaysian Inland Revenue Board Issued The Faqs On Tax Matters During The Movement Control Order

Guide To Using Lhdn E Filing To File Your Income Tax

No Extension For Income Tax Filing The Star

How To Step By Step Income Tax E Filing Guide Imoney

Notice Regarding Extension Of Filing Deadline For Labuan Corporate Tax Lbata 1990 And Personal Income Tax Bona Trust Corporation 博纳信托有限公司

Tips For Income Tax Saving L Co Chartered Accountants

Tax Season Is Coming Malaysia Business Income Tax Deadlines For 2022

Tax Season Is Coming Malaysia Business Income Tax Deadlines For 2022

Filing Income Taxes In Malaysia Mystery Solved By Other Expats Medium

Tax Season Is Coming Malaysia Business Income Tax Deadlines For 2022

Laos To Implement New Income Tax Rates Income Tax Lao Peoples Democratic Republic

Important Dates For 2022 Tax Returns Leh Leo Radio News

:max_bytes(150000):strip_icc()/Clipboard01-ff7baf48e79f47d79d4510e9e9bf728f.jpg)